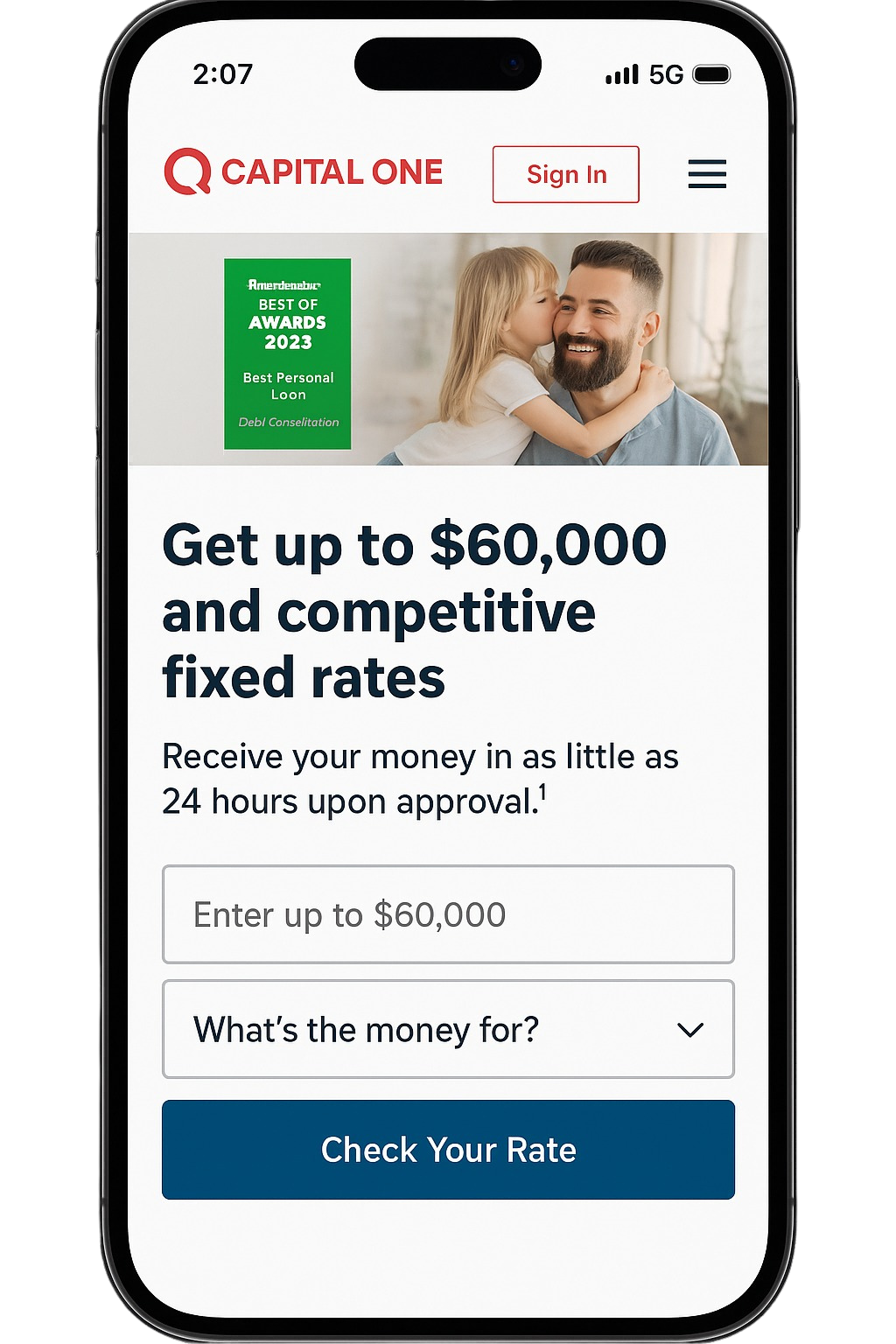

Get customized loan options based on what you tell us.

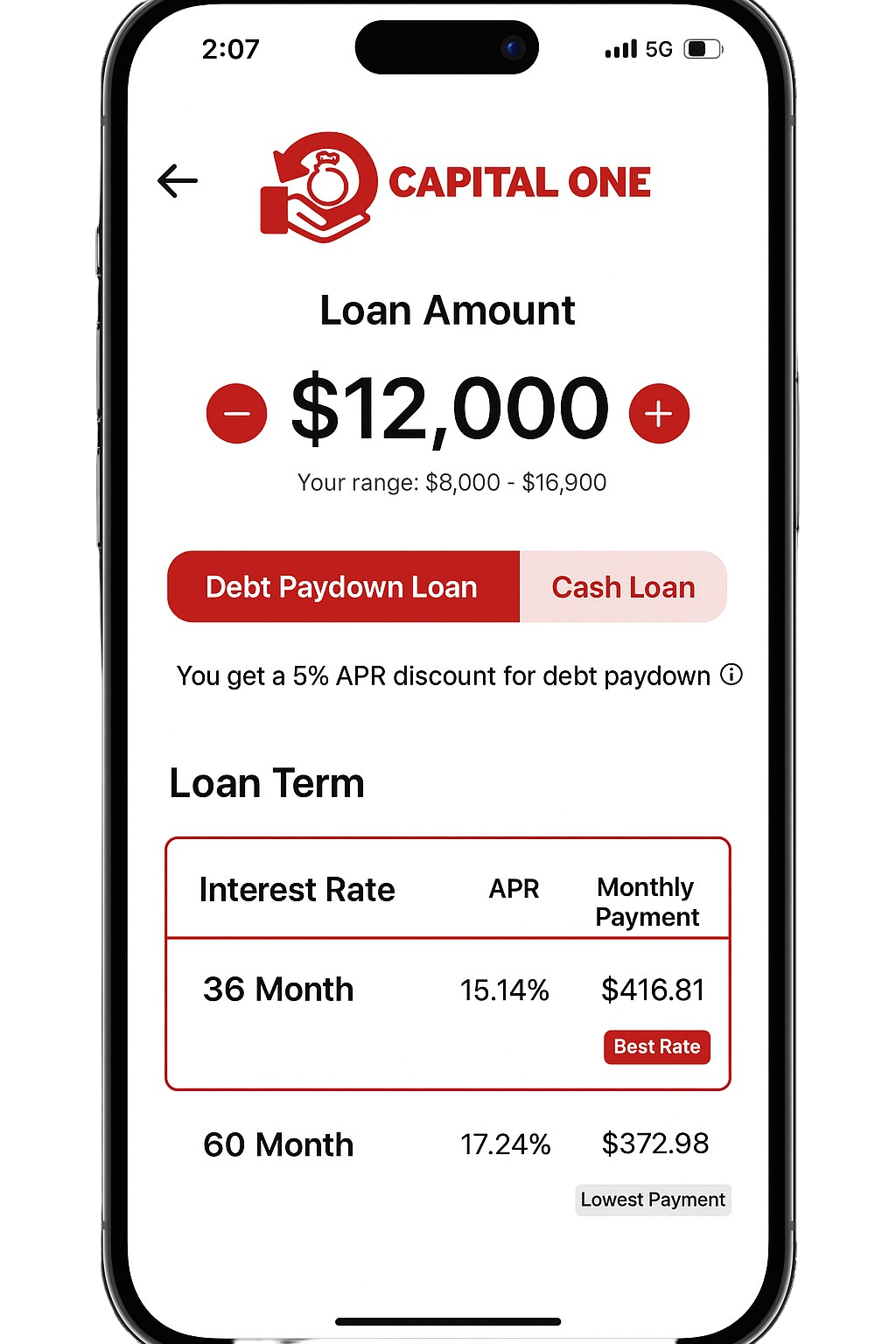

Select the rate, term, and payment options you like best.

Once your loan is approved for funding, we’ll pay your creditors directly or send the money in as little as 24 hours. 1

A personal loan allows you to borrow money from a lender for almost any purpose, typically with a fixed term, a fixed interest rate, and a regular monthly payment schedule. Collateral is usually not required and personal loans typically have lower interest rates than most credit cards.

Since interest rates and loan terms on a personal loan are fixed, you can select a loan and payment amount that fits within your budget—which is great when you’re consolidating debt. Plus, you’ll know the exact date your loan will be fully paid off.

Using a personal loan to consolidate high-interest credit card debt might even help you improve your credit score, by diversifying your credit mix, showing that you can make on-time monthly payments, and reduce your total debt.

Borrow up to $60,000

Funding in as little as 24 hours1

Competitive fixed rates and fixed monthly payments

No prepayment fees

Automatic payment withdrawals

Refinance your credit cards with a personal loan—and know the exact date your loan will be paid off.

Lock in a lower APR and save time by paying creditors directly through LendingClub—just tell us who to pay and how much.

Simplify your debt—and your life—with a single monthly payment on an affordable, fixed-rate loan.

Start your home improvement project now, without waiting for a home equity loan or line of credit.