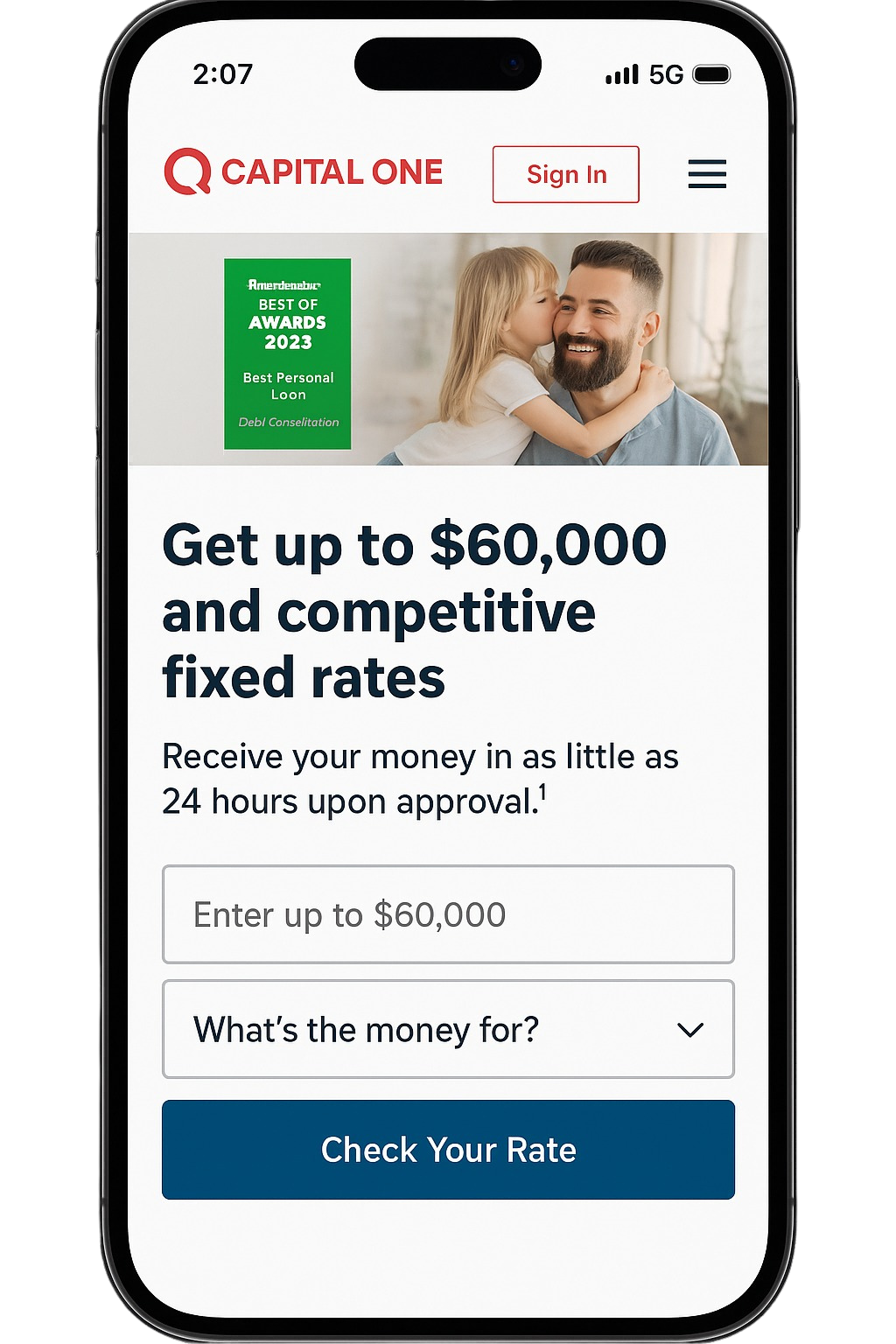

Complete a simple, secure online application. Tell us about your education goals and financial needs, and we’ll match you with customized loan options.

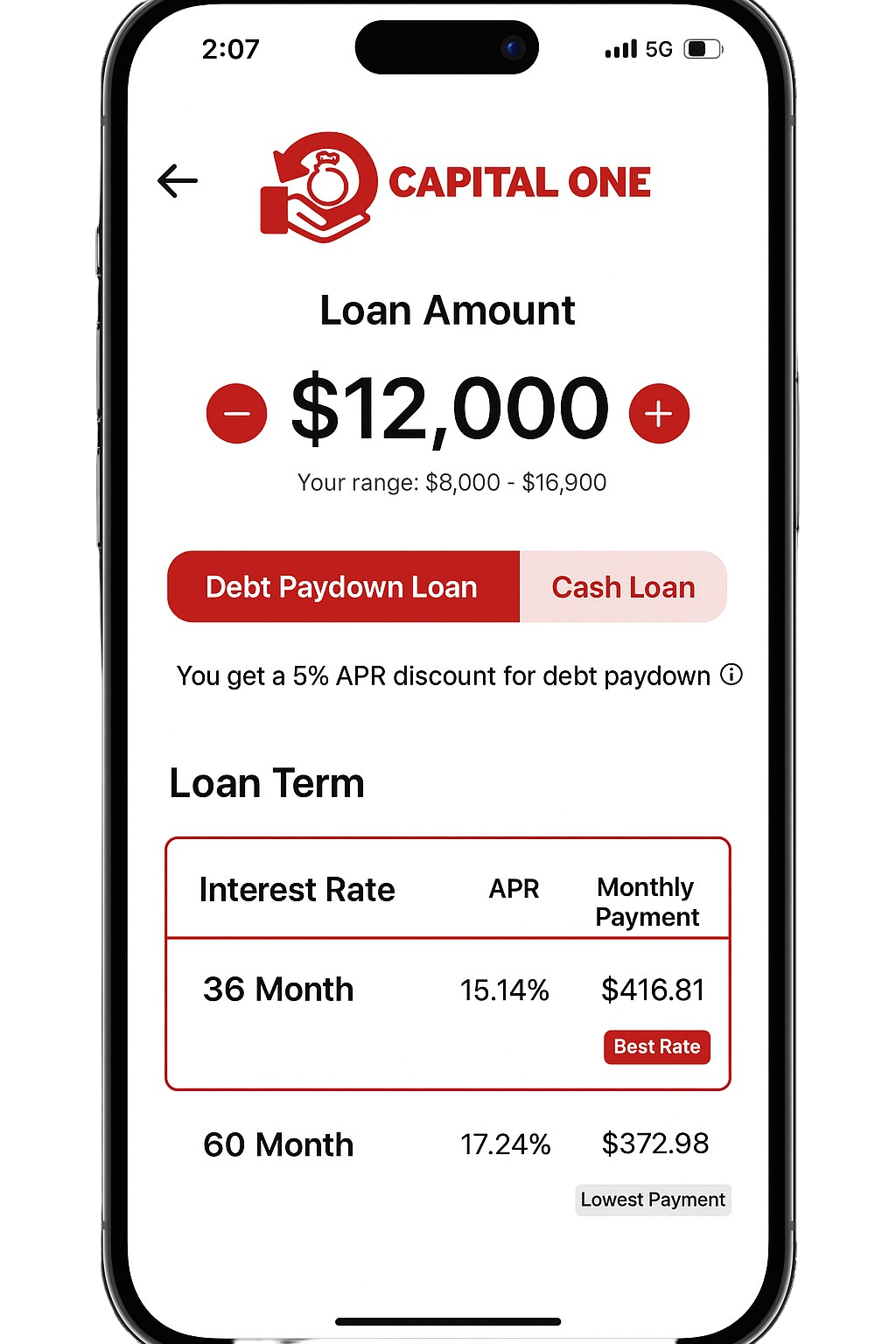

Review your personalized loan options—select the rate, term, and monthly payment that works best for your budget and education timeline.

Once approved, you could receive your funds in as little as 24 hours. We’ll send the money directly to your school or to you, depending on your loan type.

An education loan helps you finance tuition, books, housing, and other school-related costs. It’s a smart way to invest in your future—without putting your finances on hold.

Benefits of Capital One Education Loans:

Whether you’re heading to college, graduate school, or a certification program, an education loan gives you the flexibility to focus on learning—not how to pay for it.

Join Thousands of Students Nationwide

Pay for your college or grad school tuition upfront—without dipping into savings.

Cover textbooks, laptops, lab fees, and other essential learning tools.

Whether on-campus or off, use your loan to help pay rent or dorm costs.

Already have student loans? Refinance with us for better rates, lower payments, or simplified monthly budgeting.