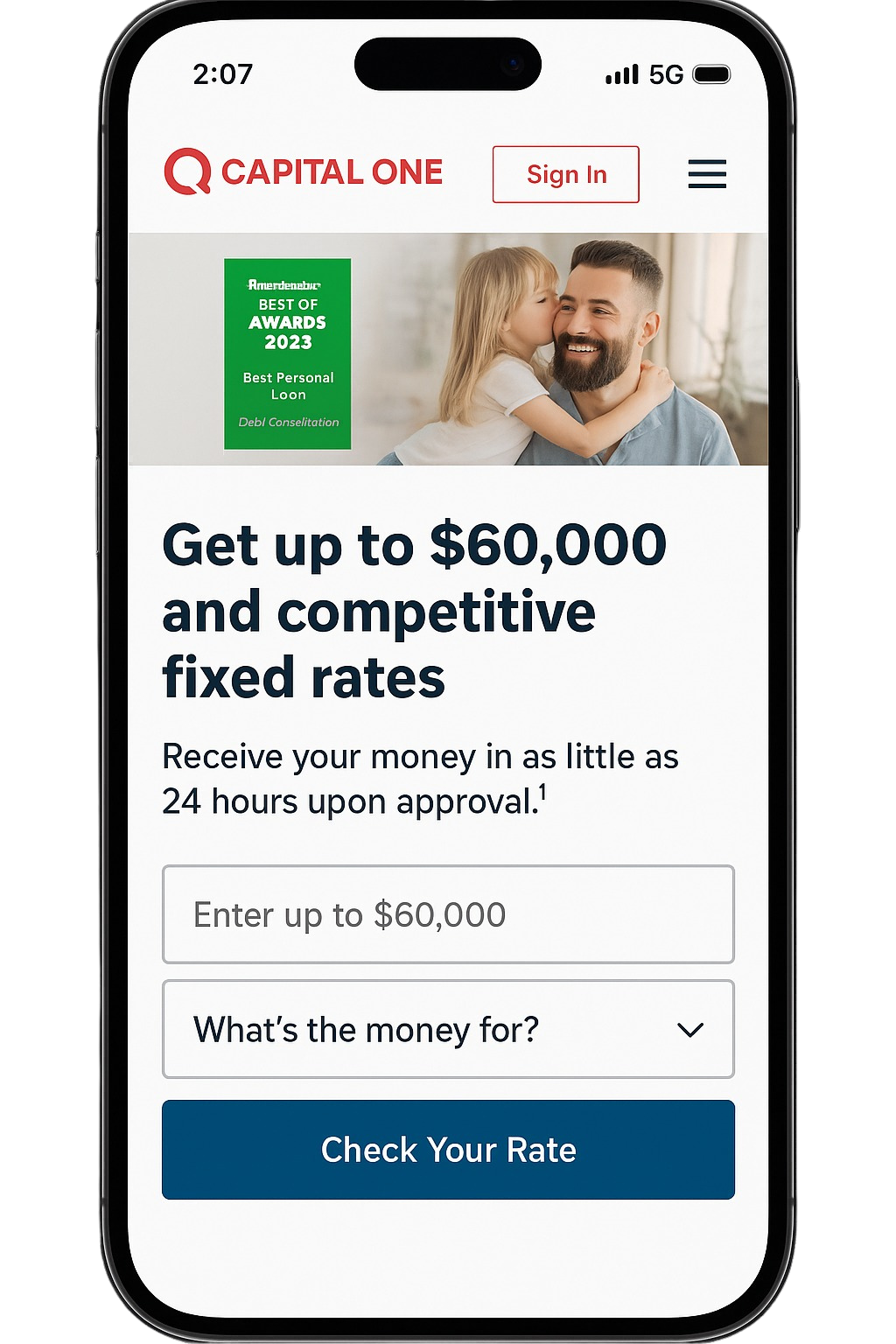

Start with a quick and secure online application. Share your business needs, financials, and goals—we’ll match you with tailored loan options.

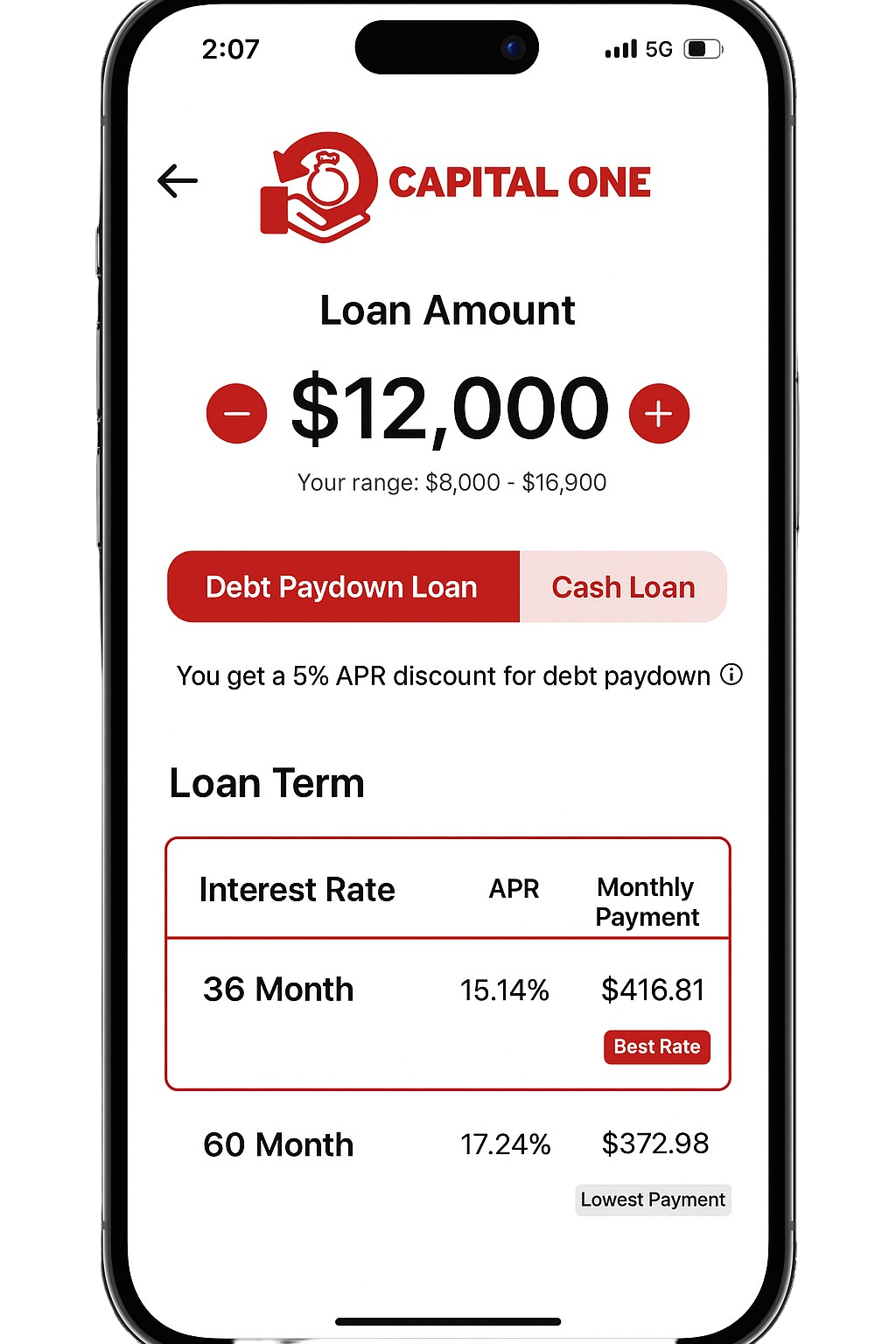

Select the rate, repayment term, and monthly payment that fits your business cash flow and growth plan.

Once approved, receive your funds in as little as 24 hours—so you can invest in your business right away.

A business loan provides the capital you need to expand, operate, or stabilize your business. Whether you’re investing in inventory, equipment, or hiring, a business loan offers flexibility and predictable repayment—with no need to give up equity.

Benefits of Capital One Business Loans:

Join Thousands of Small Business Owners Nationwide

Cover day-to-day operating expenses and keep your business running smoothly.

Open a new location, launch a new product, or expand your team.

Upgrade or purchase essential equipment without draining your cash reserves.

Stock up ahead of busy seasons or invest in new product lines.