A Commercial Vehicle Loan provides the funds you need to purchase or lease work-related vehicles—whether it’s a truck, van, or fleet. Stay on the road, fulfill contracts, and grow your operations without tying up your working capital.

Benefits of Capital One Commercial Vehicle Loans:

Join Thousands of Business Owners Nationwide

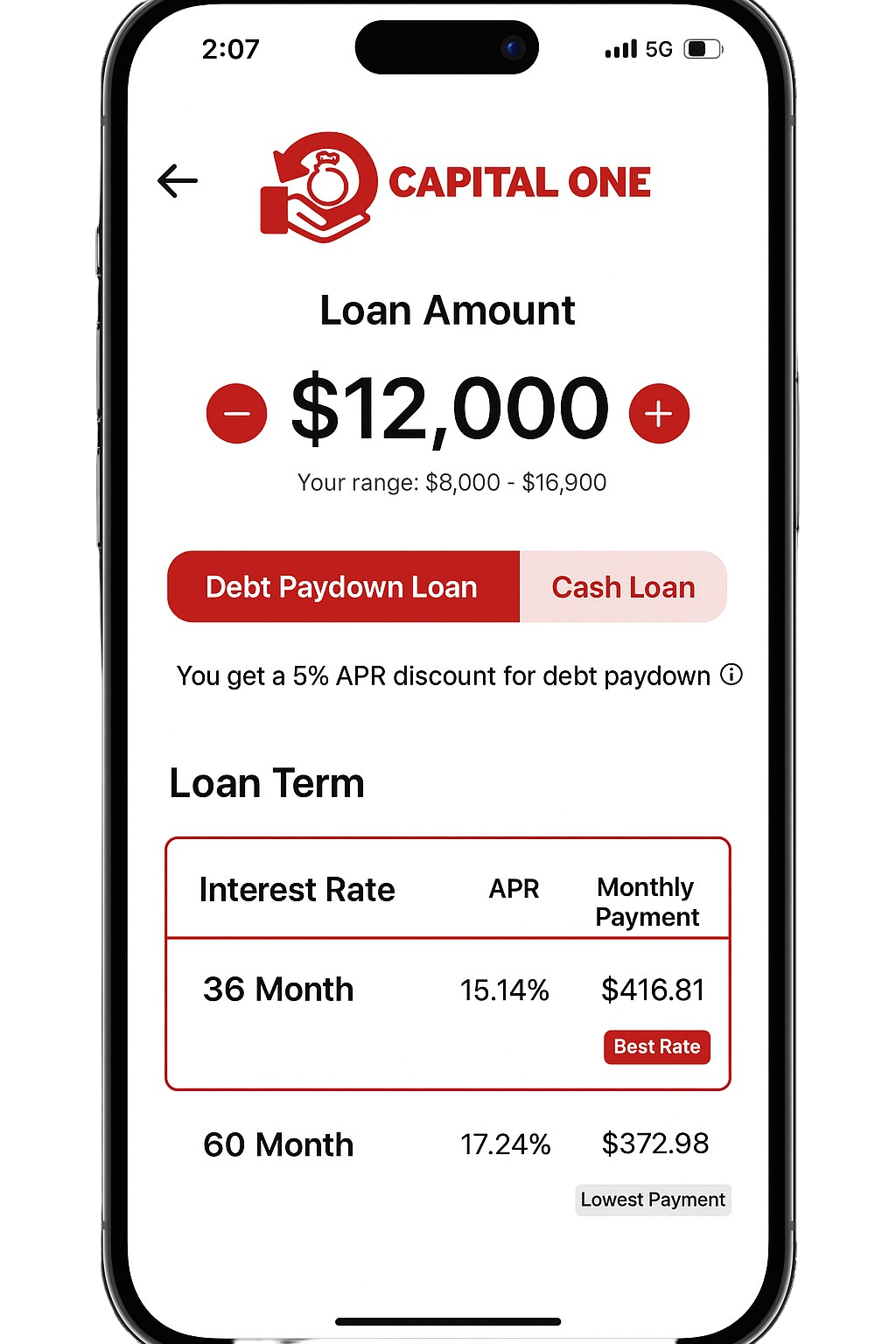

🚚 Finance up to $500,000

⏱️ Get funded in as little as 24 hours

📈 Flexible terms and fixed rates

🧰 Ideal for contractors, delivery services, logistics, and more

Upgrade or add more vehicles to meet growing customer demand.

Replace outdated or high-maintenance vehicles with newer, reliable models.

Launch your independent business with the right equipment and support.

Keep up with e-commerce growth by investing in agile delivery vehicles.